Aussie hit as Private Capex misses estimate

Expenditure shrinks most in seven quarters

Australia’s private capital expenditure declined 2.5% in Q2, the most since 2016, data released by the Australian Bureau of Statistics today showed. Expectations were for an increase of 0.6% so the big miss was a negative for the Australian dollar. AUD/USD fell as much as 0.5% to 0.7275 after the data and appears set to test the lower parameter of a triangle pattern which has been forming since August 15.

The Aussie was already on the defensive after local bank Westpac announced yesterday a hike in rates for floating rate mortgages due to higher funding costs. This heightened fears that the rest of the big four banks would follow suit and raised concerns about the implications for mortgage payers and subsequently the housing market.

AUD/USD Daily Chart

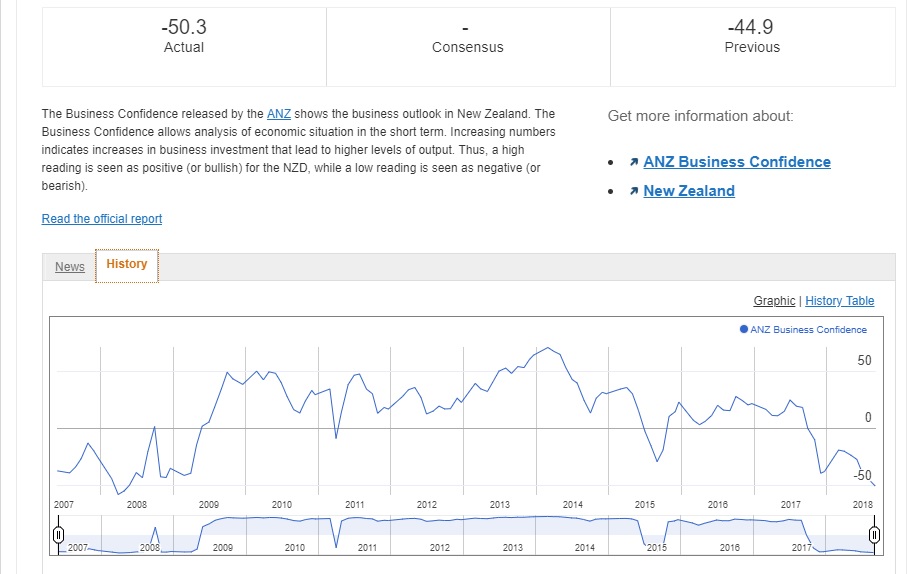

Kiwi drops as NZ business confidence lowest in 10 years

New Zealand business confidence, as measured by ANZ, dipped to its lowest level since April 2008, August data released today showed. The index slid to -50.3, the lowest reading since April 2008. The components of the index were all negative, which would not bode well for GDP growth going forward. The kiwi declined in line with the deteriorating data, dropping 0.8% to 0.6664.

ANZ Business Confidence

Q2 GDP the icing on the cake for the Canadian dollar?

The Canadian dollar has been enjoying a good run of late, rallying amid hopes that some progress in a renegotiated NAFTA deal will the forthcoming by the end of the week, hot on the heels of the US-Mexico agreement. High expectations have already been built in, with economists anticipating a sharp jump to 3.0% growth quarter-on-quarter. This would be a hefty jump from the +1.3% recorded in Q1. USD/CAD has stemmed a four-day decline today, rising 0.1% in the Asian session.

Fed’s favored inflation gauge on tap

Today’s data deck includes Euro-zone consumer confidence and German consumer prices for August with US personal consumption expenditure (price index) following in the North American session. Prices are expected to show steady increases of 2.2% y/y and 0.1% m/m, both unchanged from the previous month.

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

Comments

Post a Comment