Charts for Next Week: DXY, EUR/USD, USD/JPY, USD/CNH, Gold Price & More

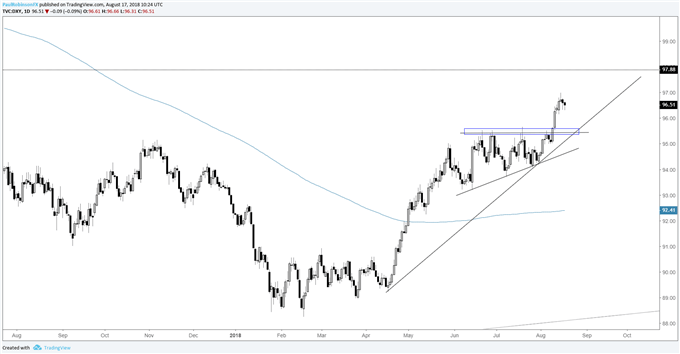

USD INDEX (DXY) BACKING-AND-FILLING IN ORDER

The US Dollar Index (DXY) is beginning to roll over, and after seeing the extended move coming out of the ascending wedge it is due for a breather. How that unfolds will be of significant interest in the days to follow. A benign decline could soon set the dollar up for another run higher in the days ahead. A retest of the top of the wedge or trend-line from April may come into play, but as long as it holds a bullish outlook remains well intact.

US DOLLAR INDEX (DXY) DAILY CHART

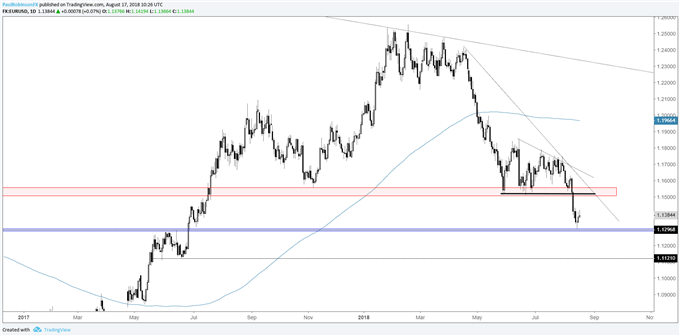

EUR/USD TO BACK-AND-FILL, POTENTIALLY TEST 11500

Next week may bring a retest of the widely-watched 11500 level that the euro broke last Friday. It could offer a solid risk/reward spot from which traders can enter short on a pullback. If sellers show up ahead of time, then a consolidation breakdown trade may present itself on a thorough break of 11300.

EUR/USD DAILY CHART (BACK-AND-FILL)

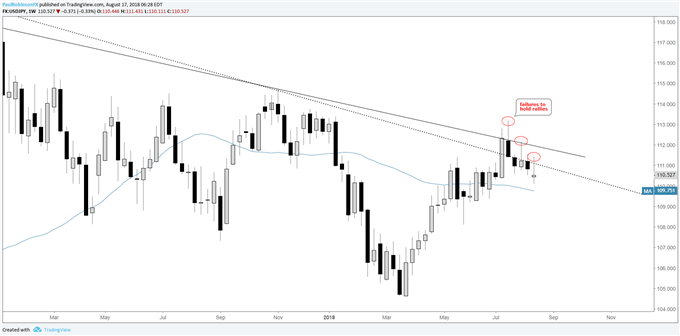

USD/JPY COULD BE ON THE VERGE OF BREAKING DOWN

USD/JPY is close to posting its 3rd weekly reversal in the past five weeks. The inability to hold rallies around resistance suggests we could soon see downside follow-through. A break below the Monday low at 11011 should usher in more selling, with the 108/109 area initially targeted.

USD/JPY WEEKLY CHART (UNABLE TO HOLD A RALLY)

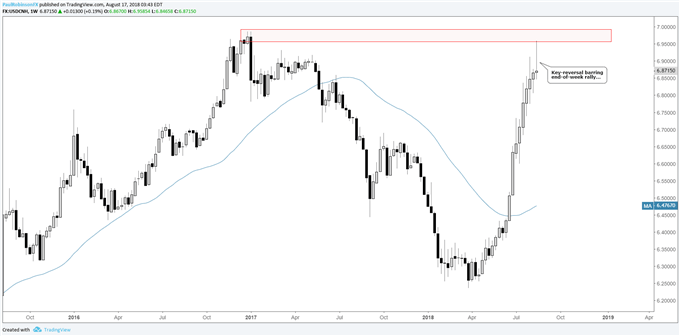

USD/CNH WEEKLY REVERSAL (IF IT HOLDS) POINTS TO WEAKNESS

As we discussed earlier in the morning, USD/CNH is in the process of cementing a key-reversal bar around the December 2016 high. If the weekly reversal holds in place without a rally today ruining the formation, then downside follow-through could be in store for next week.

USD/CNH WEEKLY CHART (KEY-REVERSAL NEAR COMPLETION)

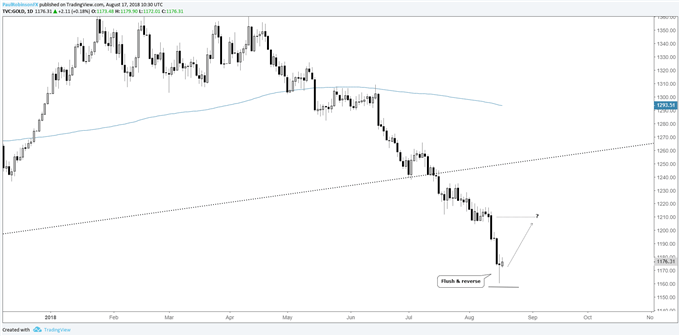

GOLD TO BENEFIT FROM WEAKENING DOLLAR AFTER FLUSH-AND-REVERSE

Gold may have very well undergone a capitulation-style bottom this week, with a strong flush-and-reverse in momentum. As long the Thursday low at 1160 holds on a closing basis look for higher prices to unfold as the dollar takes a break from rallying. This trade is tied to CNH (correlation between the two is 97%), so keep an eye on USD/CNH and be mindful of total risk if trading both.

GOLD DAILY CHART (DOWNDRAFT & REVERSAL)

Start Trading with Free $30 : CLAIM NOW $30

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

Comments

Post a Comment