EUR/USD Has 5 Consecutive Bear Trend Days

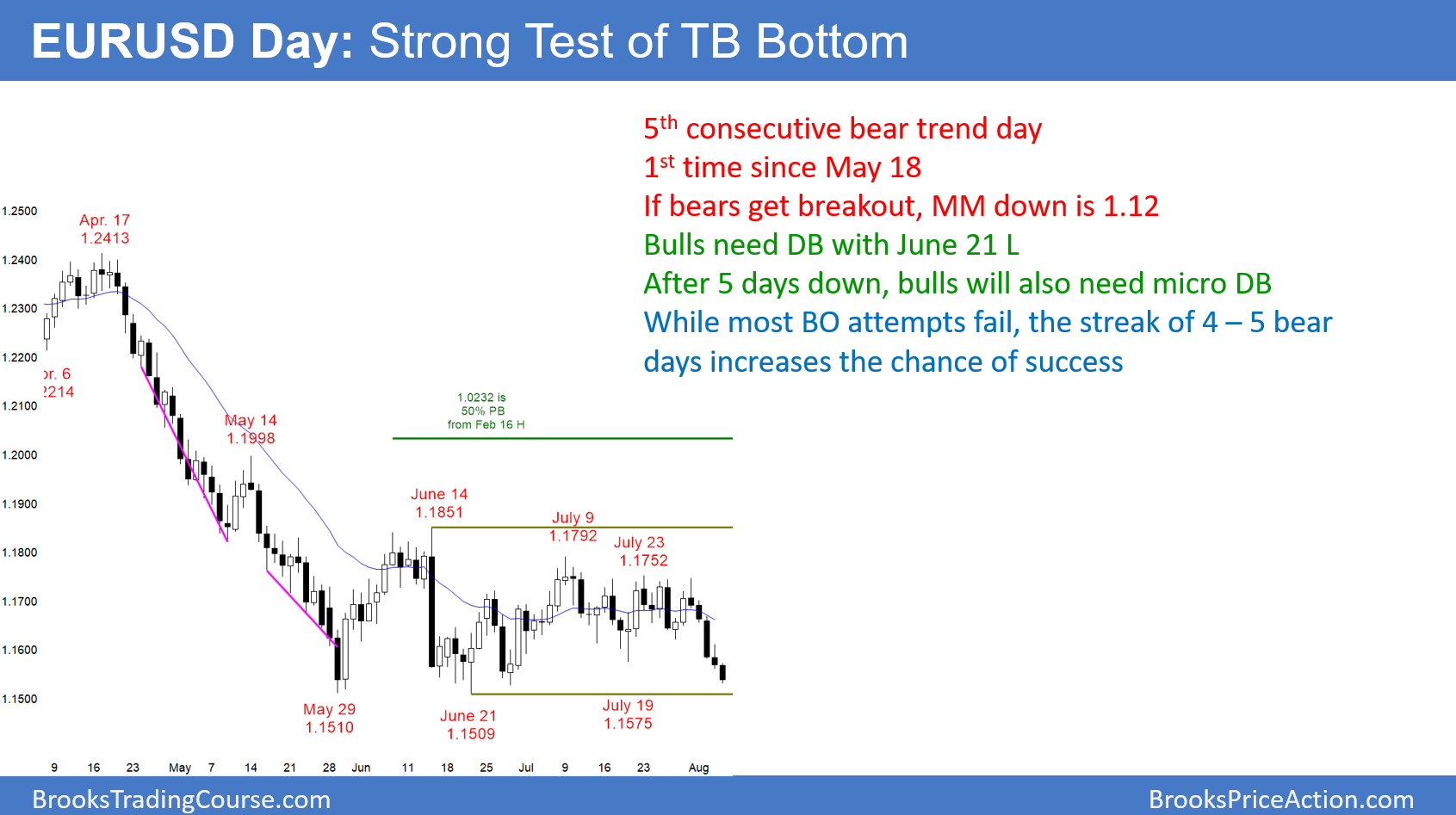

The EUR/USD daily Forex chart has a bear trend day so far today today. If it remains a bear day, it will create the 1st streak of 5 consecutive bear days since May 18. Even if it does not, there have not been 4 consecutive trend days up or down in the entire 3 month trading range. This increases the chances of a successful bear breakout.

The EUR/USD daily Forex chart had its 4th consecutive bear trend day on Friday. This is the 1st streak of 4 trend days up or down in the entire 3 month trading range. So far, today is another bear trend day. The last streak of 5 consecutive trend days up or down came during the May collapse.

All trading ranges eventually breakout, even though most attempts lead to reversals and a continuation of the range. This breakout attempt is different. Whenever a trading range begins to have a streak of 4 or 5 consecutive trend days up or down, the odds are that a successful breakout is about to happen. Here, the bear days are a sign of sustained selling pressure. Therefore, traders should expect a break below 1.15 within the next week. This is true even if there is a 100 pip reversal up to around the 20 day EMA 1st. Therefore, traders will sell rallies.

Furthermore, traders will look for the selloff to fall for about a measured move down. Since the 3 month range is about 300 pips tall, traders will look for the move to reach around 1.12 over the next few months. Unless the bulls create a very strong reversal up before then, the odds are that the bear trend is resuming.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart sold off 40 pips overnight. While the past 5 days have not been big bear days, the number of bear days is important. A chart has 2 variables, price and time. Many trends begin with time (a streak of trend days) before price. Traders now believe that there will be a successful breakout below the 3 month range.

Every trend will have many reversal attempts. But, my 80% inertia rule also applies to trends. Once a market is in a trend, 80% of reversal attempts will fail and become bear flags. While the daily chart is still in its 3 month range, it is also in an early bear trend. Therefore, day traders will look to sell 50 – 100 pip rallies this week. They expect each to lead to a new low.

Because the selloff on the 5 minute chart was not climactic, bull day traders are buying reversals for 10 – 20 pip scalps. The bears will sell rallies for scalps and swings.

Start Trading with Free $30 : CLAIM NOW $30

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

SUPPORT , CLICK SMS BAR ABOVE THEN TALK TO US.

Comments

Post a Comment