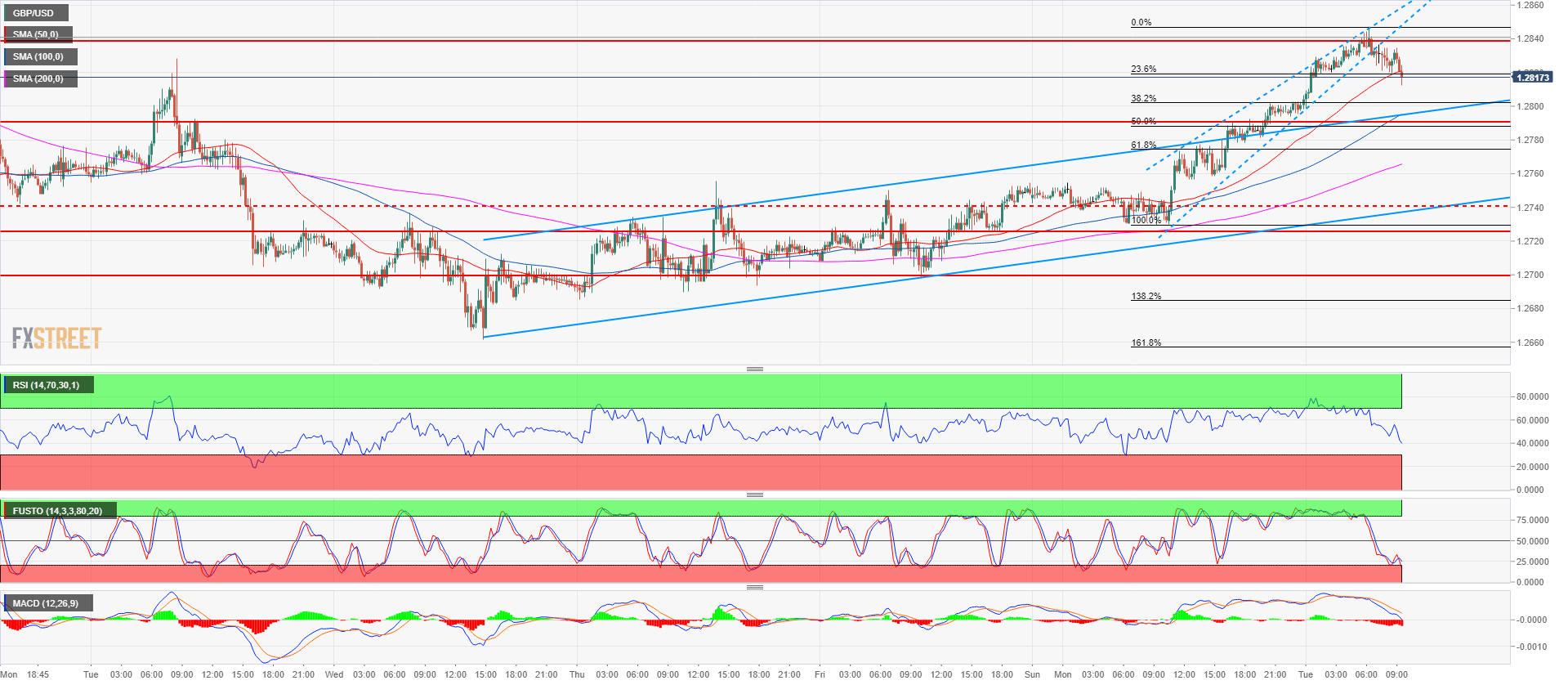

GBP/USD Technical Analysis: Target at 1.2838 mission accomplished - What is next after rising wedge?

- GBP/USD main bear trend is on hold for the fifth consecutive day as the market is having a bullish pullback.

- GBP/USD had a spike breaking above the bullish channel in a rising wedge shape, suggesting that the market went too far too fast. The correction might extend near 1.2789-1.2800 support coinciding with the 50% Fibonacci retracement of the last bull leg from Monday.

- If the market reaches 1.2789-1.2800 support, traders will be watching the market reaction in order to decide if the short-term bullish momentum is still in place.

GBP/USD 15-minute chart

Spot rate: 1.2819

Relative change: 0.17%

High: 1.2847

Low: 1.2793

Trend: Bearish

Short-term trend: Bullish

Short-term trend: Bullish

Resistance 1: 1.2838, August 10 high

Resistance 2: 1.2900-1.2923 area, figure and August 7 low

Resistance 3: 1.2957 July 17 low

Resistance 2: 1.2900-1.2923 area, figure and August 7 low

Resistance 3: 1.2957 July 17 low

Support 1: 1.2789-1.2800 area, intraday swing high and figure

Support 2: 1.2723, August 10 low

Support 3: 1.2700 figure

Support 4: 1.2661, current 2018 low

Support 5: 1.2589 June 21, 2017 low

Support 6: 1.2500 figure

Support 7: 1.2365 April 7, 2017 high

Support 2: 1.2723, August 10 low

Support 3: 1.2700 figure

Support 4: 1.2661, current 2018 low

Support 5: 1.2589 June 21, 2017 low

Support 6: 1.2500 figure

Support 7: 1.2365 April 7, 2017 high

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

Comments

Post a Comment