Softening U.S. Consumer Confidence to Fuel EUR/USD Rate Recovery

TRADING THE NEWS: U.S. CONSUMER CONFIDENCE

A downtick in the U.S. Consumer Confidence survey may fuel the recent weakness in the dollar as it casts doubts for four Fed rate-hikes in 2018.

Recent markets from Chairman Jerome Powell suggest the Federal Open Market Committee (FOMC) will continue to normalize monetary policy as ‘further gradual increases in the target range for the federal funds rate will likely be appropriate,’ but signs of a slowing economy may dampen the scope for an extended hiking-cycle as ‘there does not seem to be an elevated risk of overheating.’

With that said, Chairman Powell & Co. may continue to project a neutral Fed Funds rate of 2.75% to 3.00% at the next interest rate decision on September 26, but another unexpected improvement in household sentiment may spark a bullish reaction in the greenback as it boosts the outlook for growth and inflation.

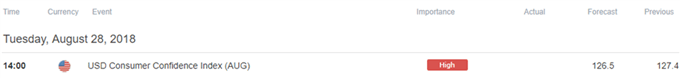

IMPACT THAT THE U.S. CONSUMER CONFIDENCE SURVEY HAS HAD ON EUR/USD DURING THE LAST PRINT

Period

|

Data Released

|

Estimate

|

Actual

|

Pips Change

(1 Hour post event )

|

Pips Change

(End of Day post event)

|

JUL

2018

|

07/31/2018 14:00:00 GMT

|

126.0

|

127.4

|

-5

|

-15

|

July 2018 U.S. Consumer Confidence

EUR/USD 5-Minute Chart

The Conference Board’s U.S. Consumer Confidence survey unexpectedly climbed to 127.4 from a revised 127.1 in June, while the gauge for future expectations narrowed to 101.7 from 104.0 during the same period. Despite the mixed prints, key developments coming out of the economy may keep the Federal Reserve on course to further normalize monetary policy as the central bank largely achieves its dual mandate for full-employment and price stability.

Despite the limited reaction, EUR/USD tracked lower throughout North American trade, with the exchange rate slipping below the 1.1700 handle to end the day at 1.1691.

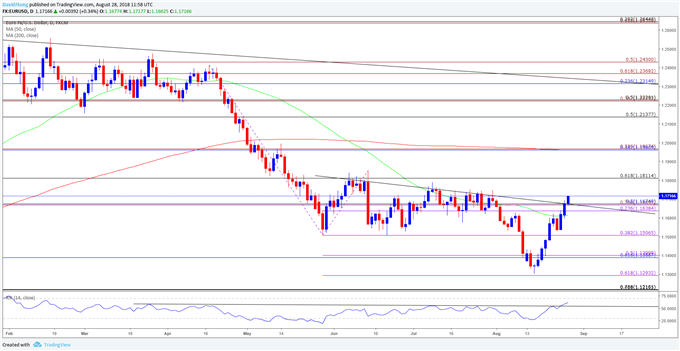

EUR/USD DAILY CHART

- The rebound from the 2018-low (1.1301) continues to gather pace, with the close above the 1.1640 (23.6% expansion) to 1.1680 (50% retracement) region raising the risk for a move back towards 1.1810 (61.8% retracement), which largely lines up with the July-high (1.1791).

- Keeping a close eye on the RSI as it appears to be leading price, with the oscillator breaking trendline resistance, with the next region of interest comes in around 1.1960 (38.2% retracement) to 1.1970 (23.6% expansion).

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

Comments

Post a Comment