USD Holds Onto Gains, US GDP Revised Higher - US Market Open

MARKET DEVELOPMENTS – US GDP STRONGEST IN 4 YEARS AFTER SURPRISE BEAT

AUD: The Aussie is the worst performing currency is the G10 space today after Westpac hiked their home loan rates by 14bps. This is largely due to their recent decline in net interest margins which has been plagued by rising wholesale funding costs, as such, it is possible that the rest of the other big 4 Australian banks will follow suit. This in turn reduces the RBA’s scope to increase interest rates, consequently prompting the RBA to keep rates at record lows for longer. Consequently, the near-term fundamentals remain soft for the Australian Dollar, resistance from 0.7350 through to 0.7400 to cap near term upside. A test for the recent lows at 0.7200 is on the cards.

USD: Second estimate of US GDP data surprises to the upside with a reading of 4.2% vs. Exp. 4%, which is the highest level in 4 years. Subsequently, this has provided allowed the greenback to hold onto its best levels of the day against its major counterparts. Euro fails to break above 1.17, over 3bln worth of option expiries between 1.1650-1.1680 has seen the Euro trade in a relatively narrow range.

Crude Oil: Oil prices are a nudge higher this morning, with Brent crude futures back above $76 a barrel, dismissing yesterday’s slightly bearish API report as focus turns to Iran. Reports from WSJ stated that Iran’s crude oil and condensate exports in August are set to drop below 70mln bpd for the first time since April 2017, ahead of the second round of US sanctions on November 4th. This consequently suggests that countries are indeed following the United States demands in regard to reducing Iranian oil imports.

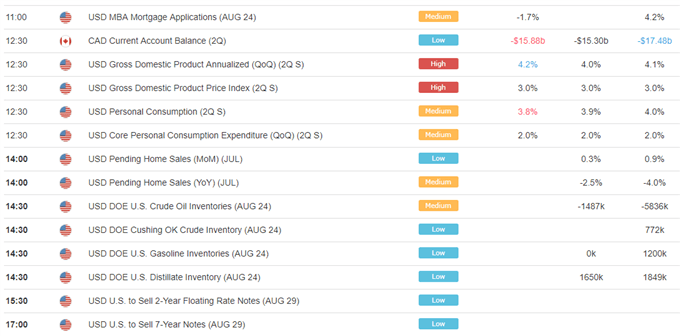

Wednesday, August 29, 2018 – North American Releases

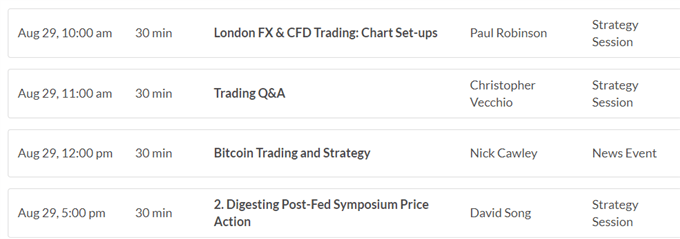

Wednesday, August 29, 2018

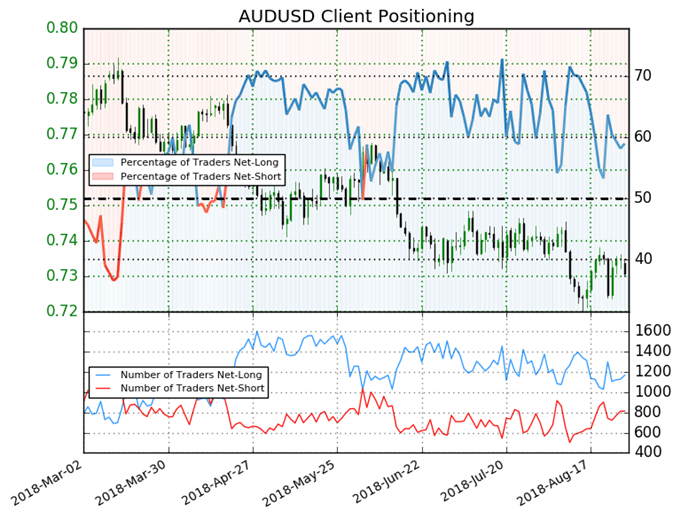

AUDUSD Chart of the Day

AUDUSD: Data shows 59.0% of traders are net-long with the ratio of traders long to short at 1.44 to 1. In fact, traders have remained net-long since Jun 05 when AUDUSD traded near 0.75794; price has moved 3.6% lower since then. The number of traders net-long is 0.3% higher than yesterday and 8.9% higher from last week, while the number of traders net-short is 2.1% higher than yesterday and 12.0% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed AUDUSD trading bias.

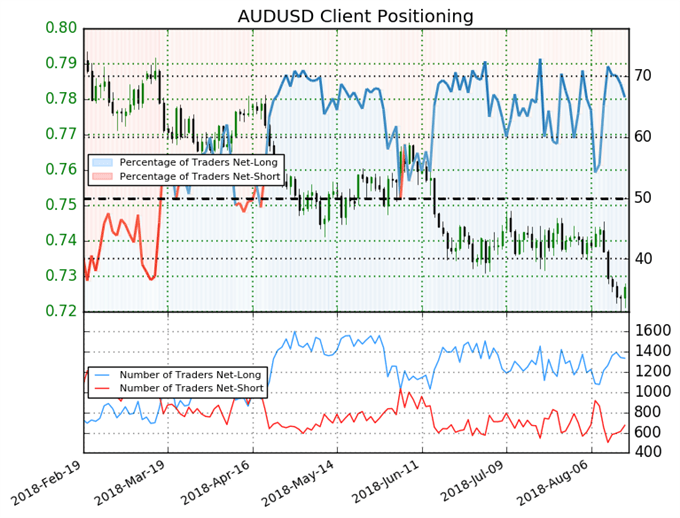

AUDUSD: Data shows 66.5% of traders are net-long with the ratio of traders long to short at 1.99 to 1. In fact, traders have remained net-long since Jun 05 when AUDUSD traded near 0.75575; price has moved 3.8% lower since then. The number of traders net-long is 4.9% lower than yesterday and 23.9% higher from last week, while the number of traders net-short is 8.9% higher than yesterday and 26.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUDUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week.

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

Comments

Post a Comment