USD/CAD Risks Ending Uptrend as NAFTA Progresses, Stocks May Rise

ASIA & PACIFIC MARKET OPEN – USD/CAD, NAFTA, USD, S&P 500, AUD, JPY

- US and Mexico made progress on NAFTA talks, boosting the Canadian Dollar

- Asia/Pacific shares may echo gains from Wall Street where the S&P 500 rose

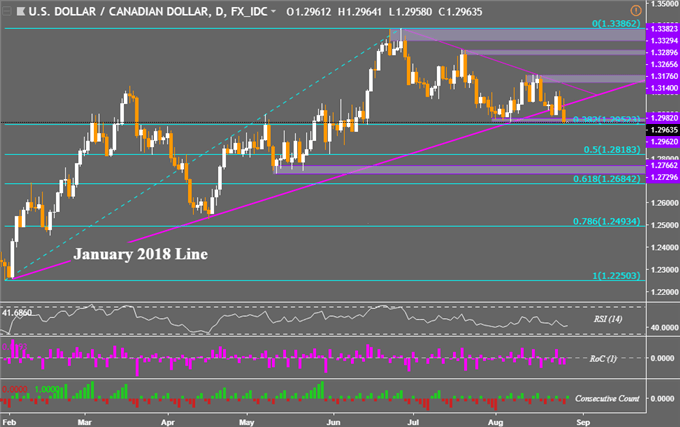

- USD/CAD broke below the January 2018 rising trend line, risking a reversal

The Canadian Dollar outperformed against its major counterparts, bolstered during the US trading session as reports crossed the wires that Mexico reached a partial deal on NAFTA with its northern neighbor. Local government bond yields also soared, the two-year reached its highest since October 2008. With Canada left out of NAFTA talks while the other two reach an accord, they may soon be back at the table.

In the aftermath of the announcement, details from US President Donald Trump on the progress failed to offer more CAD gains. He noted that “we’ll see if Canada is separate or part of the Mexico deal”. White House Economic Adviser Larry Kudlow then said that they might resort to auto tariffs if Canada rejects the deal. This could lead to a situation where it would be difficult for Canada to reject the pact which potentially weakens their negotiating powers.

Market mood continued to improve as expected following last week’s comments from Fed Chair Jerome Powell which disappointed hawkish bets. Stocks closed higher throughout the APAC, European and US trading session (S&P 500 +0.77%, NASDAQComposite +0.94%). This allowed the sentiment-linked Australian Dollar to pare partial losses from earlier in the session as NAFTA news further lifted stocks.

The combination in gains from the US Dollar’s major competitors (including the Euro as well) weighed against it. This was despite a rally in US government bond yields as investors perhaps sold local debt in favor of riskier assets such as equities. The bid/cover ratio in US 3M, 6M and 2Y bonds all weakened at auction today.

Ahead, another quiet Asia/Pacific trading session could allow local benchmark indexes to echo gains from Wall Street. This could lead to the anti-risk Japanese Yen weakening against most of its major counterparts excluding the US Dollar perhaps. Meanwhile, the sentiment-sensitive AUD and NZD could receive more fuel to their upside momentum.

USD/CAD TECHNICAL ANALYSIS – JANUARY UPTREND BROKEN

While the US Dollar uptrend still holds, USD/CAD has managed to close under both the January 2018 line and the range of lows set in early August. This could open the door for the pair to continue declining, reversing the dominant uptrend that kept it afloat for most of this year so far. Curiously, the pair was unable to break under the 38.2% Fibonacci retracement at 1.2952. A descent through it exposes the 50% midpoint at 1.2818.

US TRADING SESSION

ASIA PACIFIC TRADING SESSION

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

Comments

Post a Comment